For the Plantation Owners

Back to the farm subsidies – again. In the light of the previous pages, we see that farm subsidies are subsidies of land owners – at the expense of Labor. Consider: farms consume huge amounts of land, land that could be used for housing or natural habitat. True, those who live near farms get to enjoy the open vistas they provide, and animals to varying degrees share the fields and pasture lands of farmers. Also, many farms include actual wilderness area along with fields. But still, farms use a tremendous amount of land, less intensely than cities and suburbs use land, but a tremendous quantity nonetheless.

Farm subsidies provide cash to those who own these great tracts of land. They also bolster real estate prices for non farmland by producing scarcity. Farm subsidies also raise food prices, which puts the greatest burden on the poor, or at least those poor people who are not on Food Stamps. Yet, farm subsidies are sold as being “progressive” since they are supposed to help preserve the small family farm.

Do they actually preserve the small family farm? If so, what happened to the small farmers? Was it simply a matter of not enough subsidies? The answer is that farm subsidies do not answer the issue of economies of scale. If big farms are more profitable than small farms, then small farms will get squeezed out over time regardless of the subsidy level.

While it is true that existing small farmers do benefit from higher farm prices, the reality is that not everyone wants to be a farmer. The descendents of small farmers may opt for other careers. At this point the farm goes up for sale or lease. High farm product prices raise land prices. For those who want to go into small farming, the benefit of the subsidy is already discounted into land prices. So the primary benefit of the farm subsidy is to those who own farmland before the subsidy went into effect.

If you inherit a big old plantation, then you are a prime beneficiary of farm subsidies. If you are a descendent of the slaves who worked the plantation, who lives in the inner city, you get to pay for this benefit. This does not strike me as progressive.

Meanwhile, if big corporate farms can make more money per acre than smaller operations, then they can better afford to buy up small farms as the come up for sale. Thus, over time, small farms disappear despite the subsidy program, and most of the value of the subsidy goes to corporate farms and the agribusiness industry.

If preservation of the small farm lifestyle is desired, there are other ways this could be done, ways that don’t raise food prices. Here are a few possibilities:

- Have a homestead deductible on the property tax value of farms; that is, make the first x thousand dollars of farm property value tax free for those who farm their own land. This deductible would be relatively more valuable for small farms vs. big farms. Thus, we automatically target our subsidy.

- Make the first x thousand dollars of farm income tax free. Once again, the value of this tax break is much more valuable for the small farmer than the big farmer.

- End the mandatory contributions to the commodity advertising funds (the folks who run the “Got Milk?” ad campaigns and the like). Such mass marketing favors the big farms.

- More gradations of farm products. There is a wide spectrum of options between modern factory farming and completely organic. More market niches mean room for more players and less market share for the dominant players.

Also, see the proposals in the next chapter for shrinking corporations. They would discourage corporate farming to the benefit of the small farmer.

Homework Assignment

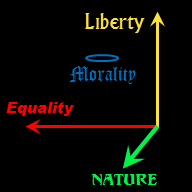

- Compare the ideas above with the theory of private property given in the chapter on “Really Natural Rights.”