More Financial Wisdom from Solomon

Solomon had a lot of money. He wrote words about the subject so that you could have more money too. I have covered the big picture in Parts 1 and 2 of Bible Money Wisdom. Here, I will cover some specific nuggets of wisdom, wisdom directly related to wealth. As before, I warn you that the keys to prosperity aren’t visualization, positive thinking or other such fun magic. Solomon took a very conservative approach to wealth, perhaps a bit more conservative than necessary in this wealthy age, with its generous welfare system, subsidies and bankruptcy laws.

On the other hand, our leaders – both political and financial – would do well to heed more of Solomon’s wisdom, as I will demonstrate next.

Do Not Sign a Loan Guarantee!

Proverbs 11:

15 The one who puts up security for a stranger will surely have trouble,

but whoever avoids shaking hands will be secure.

Proverbs 17:

18 The one who lacks wisdom strikes hands in pledge,

and puts up financial security for his neighbor.

Proverbs 22:

26 Do not be one who strikes hands in pledge

or who puts up security for debts.

27 If you do not have enough to pay,

your bed will be taken right out from under you!

(NET Bible®)

Solomon really, really, REALLY, didn’t like loan guarantees. American politicians, on the other hand, love them. Loan guarantees allow the government to pretend to lend out far more than it has – which buys a lot of votes, and directs a lot of other people’s money to projects favored by the current batch of congresscriminals.

Proverbs 6:

1 My child, if you have made a pledge for your neighbor,

and have become a guarantor for a stranger,

2 if you have been ensnared by the words you have uttered,

and have been caught by the words you have spoken,

3 then, my child, do this in order to deliver yourself,

because you have fallen into your neighbor's power:

go, humble yourself,

and appeal firmly to your neighbor.

4 Permit no sleep to your eyes

or slumber to your eyelids.

5 Deliver yourself like a gazelle from a snare,

and like a bird from the trap of the fowler.

(NET Bible®)

Loan guarantees have also brought this country many trillions of dollars in debt, and a host of financial crashes. The mortgage bubble that popped a few years ago was purely of the government’s making. The whole idea of securitizing mortgages was a government dream, with government chartered corporations to facilitate the folly.

Only lend what you are willing to put at risk. If you are parting with the money when making the loan, and tying up that money until the loan is due, you are much more likely to investigate the credit worthiness of the borrower. You will also make fewer “loans” since you run out of cash before over committing yourself – or the U.S. Treasury in the case of the irresponsible buffoons who inhabit Washington.

Loan guarantees and similar financial instruments encourage dangerous wishful thinking.

Get Rich Slowly

Proverbs 13:

11 Wealth gained quickly will dwindle away,

but the one who gathers it little by little will become rich.

Proverbs 20:

21 An inheritance gained easily in the beginning

will not be blessed in the end.

Proverbs 21:

5 The plans of the diligent lead only to plenty,

but everyone who is hasty comes only to poverty.

(NET Bible®)

I had the misfortune of being very lucky when I first tried my hands at investing in stocks. I opened an account at Schwab and bought a few hundred shares of Atari at 1 1/16, and watched it zoom up to over 10 in half a year. A few years later I went in far deeper buying up shares of Be incorporated (they had a really cool computer operating system). I could have made a killing if I had gotten out after a quick run-up. I didn’t. I continued buying on the way down, even using leverage. I think I came out slightly ahead in the end, but it wasn’t by much.

There is a magic to making money you aren’t used to having too quickly, too easily – a dark magic, a curse. Solomon described it thousands of years ago, but the story continues today. Read of the movie stars, sports champions, lottery winners, etc. who went from rags to riches to bankruptcy.

There is something to be said for going full-on conservative after a big win, to get used to having the wealth long enough so that it feels real, and that losing it would be a real loss.

There is also a magic to thinking small, to earning “little by little” as described in Proverbs 13:11 above. Incremental gains are easier to find than the big wins, and usually involve far less risk.

Proverbs 12:

11 The one who works his field will have plenty of food,

but whoever chases daydreams lacks wisdom.

Proverbs 28:

19 The one who works his land will be satisfied with food,

but whoever chases daydreams will have his fill of poverty.

20 A faithful person will have an abundance of blessings,

but the one who hastens to gain riches will not go unpunished.

(NET Bible®)

Gold rushes happen – both literal and figurative. Some people make quick fortunes during such events. Far more work hard with little or less to show for it. Solomon suggests that you play the odds, and opt for more deterministic wealth. Had I followed his advice over the course of my career, I would be far wealthier than I am today.

That said, I still continue to read those who made the “quick” wealth. It is fun reading. And they do reveal some still useful wisdom along with that which is quickly dated. But I have noticed a common pattern: most “quick” fortunes had a much longer lead-up than advertised. The rags part of the rags-to-riches story is often because the author tried going for the quick fortune a dozen times or more before finally succeeding. Other times, the author started with rather more than featured – but you can still see if you read carefully. For example, Tim Ferris of the Four Hour Workweek is the son of a doctor in a wealthy part of the country, had a long time fascination with exercise science, and took some neuro science courses at Princeton. These are the multi-year prerequisites to his successful supplement company, which he was able to outsource down to four hours per week on his part. (Start a successful business that you can sell and you can get down to a zero hour workweek…) The book has some useful ideas, and I still read his blog. But some of the book’s recommendations for readers without his impressive set of prerequisites strike me as rather shady.

Use That Thar Wisdom Thingy

Proverbs 13:

16 Every shrewd person acts with knowledge,

but a fool displays his folly.

Proverbs 14:

15 A naive person believes everything,

but the shrewd person discerns his steps.

(NET Bible®)

In the first two parts of this series, I compiled a great deal on the process of gathering wisdom. Here, Solomon reminds us to use that wisdom.

The human mind is quite capable of compartmentalizing. It is possible to understand probability theory, and still be suckered into playing slot machines or the lottery. It is possible to understand a fair amount of economics and still be suckered by an evil investment advisor who offers investments that are way too good to be true. Just ask those who turned over their savings to Bernie Madoff.

Do your research. Know the business you intend to enter. You probably shouldn’t open a restaurant if you have never worked in a restaurant. (Exception: if you have capital to burn, it may make sense to start a hobby scale business in order to learn. Just expect to lose money until you have learned.)

Then use the wisdom that you have gained from experience, mentors, reading, etc. Beware of wishful thinking, and glib hucksters. Run the numbers.

Master a Skill

Proverbs 22:

29 Do you see a person skilled in his work?

He will take his position before kings;

he will not take his position before obscure people.

(NET Bible®)

Here is perhaps the most conservative approach of all to a comfortable life: master a useful skill – or set of skills. Just be aware of the cost. It takes a lot of deliberate practice to become a true master at anything that pays well. (Do a web search on the phrase “deliberate practice” to learn what that means. Essentially, it entails doing a whole lot of drill on aspects of a skill – such as playing scales if you want to be a musician – with conscious effort to attain something close to perfection, and then moving on to the next aspect.)

By the way, if you have already mastered a useful skill, you may well be in for some “fast” money. It’s just a matter of cashing in on what you have mastered. What looks like fast money is often the endgame of a much longer game, one that often extends into childhood.

Likewise, if you have partial mastery, you may profit greatly by taking it to the next level by devising appropriate deliberate practice drills to transcend your current level. Play is a great way to gain partial mastery, but it can take serious drill to take it up to the profitable level.

Reputation and Connections – Quite Useful

Proverbs 22:

1 A good name is to be chosen rather than great wealth,

good favor more than silver or gold.

(NET Bible®)

Some of the gurus in the “millionaire mindset” field show examples of wealthy people who lost everything and bounced back very quickly. They ascribe it to some mysterious mindset.

I suggest it is more about skills, reputation, and connections. Yes, being born into old money provides automatic connections, as well as etiquette, language patterns, and a shared set of hobbies, sports, literature, etc. The latter are less important in this sensitive age, but they can still be useful. But it is more important to simply avoid being a jerk. As I covered in Part 2, Solomon had much to say against making enemies, and I didn’t cover it all. Get out your Bible and read all of Proverbs for the full dose.

As for making connections, try this:

Proverbs 18:

6 A person's gift makes room for him,

and leads him before important people.

(NET Bible®)

If you want to meet people worth knowing, get involved in a good cause. If you don’t have money, donate time. If you show up and do, when others don’t, you will get known. (This was a big upside to my political activism days. Other causes than fringe politics can get you before even more important people.)

Deferred Gratification – the Real Secret to Success

Proverbs 24:

27 Establish your work outside and get your fields ready;

afterward build your house.

(NET Bible®)

The West is wealthy today because it is capital intensive. We have tools which make tools which make tools. We invest billions and billions of dollars educating people to design, maintain and operate these tools.

What holds for society holds for individuals as well. That which you can make directly by hand is generally of far less value than that which results from less direct approaches. The McDonald brothers developed a system of producing hamburgers quickly. That system resulted in immense profits for the corporation that resulted. The same was true in Solomon’s day. You had to plow, plant, weed and harvest to get sufficient food, given the population of his day. A low overhead approach to food – hunting and gathering – only supports a small population.

To build capital requires working more and spending less. It generally involves living poorer than you would otherwise have to. I have covered hard work elsewhere. Let’s see what Solomon had to say about thrift.

Proverbs 12:

9 Better is a person of humble standing who nevertheless has a servant,

than one who pretends to be somebody important yet has no food.

Proverbs 13:

7 There is one who pretends to be rich and yet has nothing;

another pretends to be poor and yet possesses great wealth.

(NET Bible®)

A good place to start is mindset. Not millionaire mindset, but humility. A great deal of what we spend money on is for status. If you think in terms of deferring status vs. deferring spending, you may be more successful in the latter. And yes, Solomon was talking about deferring.

Proverbs 22:

4 The reward for humility and fearing the LORD

is riches and honor and life.

(NET Bible®)

The good news today is that you can save money and keep some status by being an environmentalist. At least, you don’t need an expensive big house or a succession of big shiny cars to have status among the environmentally conscious. (On the other hand, you can blow your bank account on organic foods, electric cars, alternative energy, etc. if you aren’t careful.) See the Early Retirement Extreme or Mister Money Mustache blogs for examples.

Solomon also suggests going easy on the sensual pleasures:

Proverbs 21:

17 The one who loves pleasure will be a poor person;

whoever loves wine and anointing oil will not be rich.

…

20 There is desirable treasure and olive oil in the dwelling of the wise,

but a foolish person devours all he has.

(NET Bible®)

And also on the socializing:

Proverbs 18:

24 A person who has friends may be harmed by them,

but there is a friend who sticks closer than a brother.

(NET Bible®)

These two wealth sinks can be combined:

Proverbs 23:

20 Do not spend time among drunkards,

among those who eat too much meat,

21 because drunkards and gluttons become impoverished,

and drowsiness clothes them with rags.

(NET Bible®)

And yes, excessive alcohol can be quite pernicious. (The description of a hangover below is hilarious.)

Proverbs 20:

1 Wine is a mocker and strong drink is a brawler;

whoever goes astray by them is not wise.

Proverbs 23:

29 Who has woe? Who has sorrow?

Who has contentions? Who has complaints?

Who has wounds without cause? Who has dullness of the eyes?

30 Those who linger over wine,

those who go looking for mixed wine.

31 Do not look on the wine when it is red,

when it sparkles in the cup,

when it goes down smoothly.

32 Afterward it bites like a snake,

and stings like a viper.

33 Your eyes will see strange things,

and your mind will speak perverse things.

34 And you will be like one who lies down in the midst of the sea,

and like one who lies down on the top of the rigging.

35 You will say, "They have struck me, but I am not harmed!

They beat me, but I did not know it!

When will I awake? I will look for another drink."

(NET Bible®)

Feedback and Financial Freedom

Proverbs 10:

15 The wealth of a rich person is like a fortified city,

but the poor are brought to ruin by their poverty.

Proverbs 22:

7 The rich rule over the poor,

and the borrower is servant to the lender.

(NET Bible®)

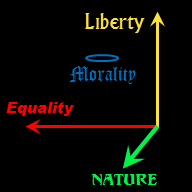

The poor are “brought to ruin” by poverty. The wealthy are protected. The wealthy also have freedom and power. By such mechanisms the wealth gap remains large despite the efforts of egalitarian politicians. The government could reduce the effect – I describe how in the red books on this site – but you cannot eliminate it without wrecking the economy.

The effect also shows why advancing “little by little” can lead to large fortunes. A surge of thrift and hard work can lead to debt reduction, which leads to a better credit rating, which leads to lower interest rates, which leads to further debt reduction. Financial equity leads to a better bargaining position, both for employment and financing terms. Further equity can make investing worthwhile, even with conservative investments. Those who are accredited investors can legally make insider profits, by investing in corporations before they go public. (Beware! This can also be very risky.)

So, even if your ambitions are grand, you may well be better off focusing on some lesser ambitions first, ambitions you can likely achieve using Solomon’s conservative approach.