Artificial Overhead

Roughly speaking, the costs of producing an item for sale can be broken down into two components: fixed costs and variable costs. Fixed costs are those costs that must be paid before the first item is made, and do no increase as the number of items increases (unless the production process is changed). Fixed costs include the costs of the building in which the item is made and the tools used to make the item. Variable costs include the materials used to make the item and the labor that goes into fabricating each part.

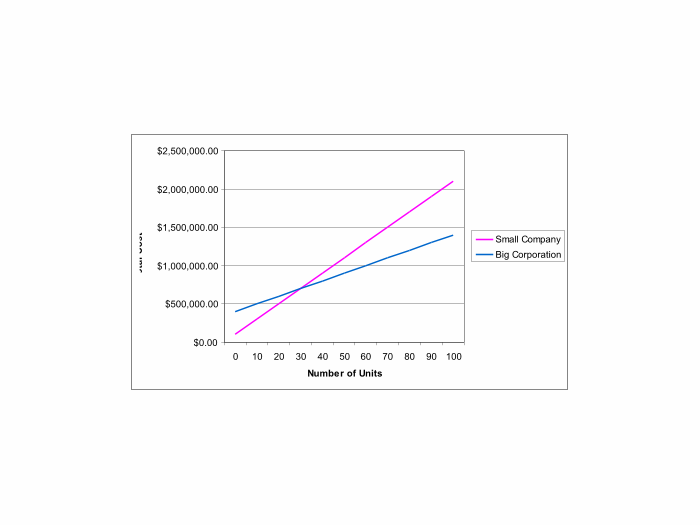

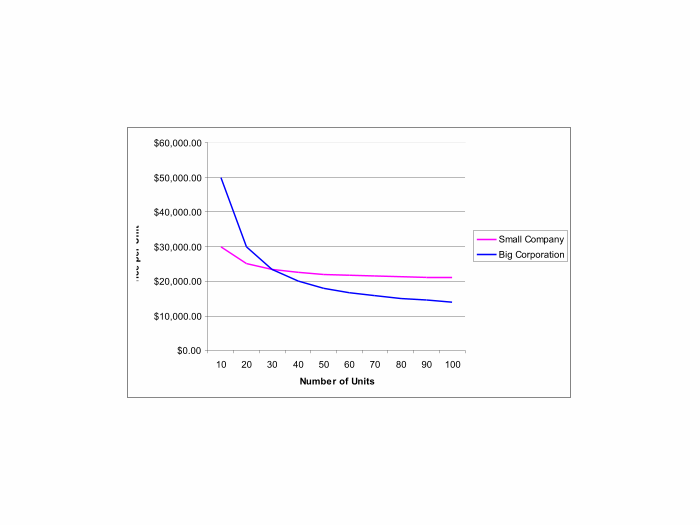

By using more specialized equipment, it is possible in many industries, to reduce variable costs through increased automation. However, this increases fixed costs. The results can be shown in the graphs below:

If the number of units bought by the market is less than where the two curves intersect, then the small company can produce more cheaply than the big corporation. However, for bigger production runs, the big corporation wins out by converting its bigger initial investment into lower per unit costs.

The more opportunities there are to convert costs into overhead, the more advantage big corporations have over smaller companies and individually owned businesses. If we can reduce the advantages of having higher overhead (making the difference in the tilts of the two lines less), we can return advantage to smaller companies.

Our current regulatory state imposes a huge overhead in the cost of doing business. However, this overhead does not scale with the size of the business. The cost of government compliance is much higher per unit of output for a small business than for a big business.

Consider the effort needed to hire employees. To legally pay any employees requires understanding federal withholding, state withholding, Social Security and Medicare withholding, federal and state unemployment insurance, and basic Department of Labor regulations. Mastering these things and setting up an accounting system able to stay in compliance is a huge undertaking for someone starting up a small business in their spare time. For an ongoing full time business, much of these efforts are sunk costs. For a bigger business, it is possible to hire people full time to handle these responsibilities.

But I am not yet done. To simply pay employees money is to pay extra tax. The tax code favors a form of corporate serfdom where the boss pays less in cash and more in benefits, such as retirement plans and insurance. There are major setup costs involved in paying benefits instead of cash. A bigger company can spread these costs over multiple employees, and even hire full time personnel managers to deal with these headaches. The result is that big companies can hire labor more cheaply than small businesses.

These supposedly progressive government programs favor big corporations over small businesses! Think on this next time you see Wal-Mart taking away business from Main Street.

But I am still not done! To stay in compliance with the law requires paying income tax on the business itself. To convey what the business’ income is in a uniform way requires following strict accounting conventions. This removes one of the major advantage that the family business has over the partnership and the corporation: the ability to operate with less paperwork. Effectively, there is no such thing as a true sole proprietorship any more, since everyone has a partner in the form of the IRS.

And when we get to the corporate level of business, there is the more complicated corporate tax code and the SEC to deal with. Once again, the bigger corporations can spread these costs better than the smaller corporations.

And if I were to spend the time to properly research such things, I could go on with labor law, zoning, environmental regulations, contract law, and so on. Some of these things are necessary, but they come with a price: fewer, bigger, businesses. To return power to the people requires legal simplification so the average person can understand the law.

Location Costs

Paperwork is not the only way that government favors the bigger business over the smaller business. At the lowest level of business, the smallest businesses are often crushed by the local government. In particular, the smallest businesses of all are operated out of the home. This eliminates the overhead of a second building in which to locate the business. It also reduces commuting costs and daycare costs.

Alas, the shade tree mechanic, the residential area beauty shop or doctor’s office are disappearing. The same goes for the neighborhood pub or mom and pop grocery store. These are the victims of zoning.

We get quieter neighborhoods this way, but we also get traffic snarls, less sense of community, higher crime, drunk driving instead of drunk walking, and longer commutes. We do get richer real estate developers, bankers and franchise corporations so I guess someone is happy.

Homework Assignment

I suspect many of you think I am exaggerating about the amount of overhead that the government imposes. Those whose only encounter with the IRS is filling out 1040EZ can get the mistaken impression that the income tax is not so bad. The fact is that you (the employee) are paying someone else (in the form of lower pay) to do the bookkeeping.

So my assignment for you is to set up a small part time business for yourself. Sell some T-shirts out of your house. Put up a lemonade stand. Or do any other such trivial business. But, hire one person part time who is not a family member and do everything by the book.

- What kind of license do you need to be able to have from your city or county to have your business? Do your local zoning laws even allow it?

- Got your federal EIN? Your state equivalent? Got your state unemployment insurance account number?

- Have you read the IRS Publication 15 Circular E, Employer's Tax Guide? IRS Publication 505 Tax Withholding and Estimated Tax?

- When and where to you deposit employee federal withholding? State withholding? Federal unemployment insurance? State unemployment insurance? State sales tax?

- Have you gotten the mandatory posters that all employers need to post, federal and state?

- Have you certified that your employee is not an illegal alien?

- Was your job interview racist? Sexist? Ageist? Are you sure?

- If you are selling lemonade, cookies, or such like, are you in compliance with local health codes? Have you checked?

- How much time did you spend on learning the above? Or, if you hired consultants, how much did you spend? Compare this to the amount of time you spent doing the actual sideline business.

Further Reading

- Populist Capitalism by Jeffry R. Fisher.

- www.irs.gov Comprehensive guides for the new employer and business owner.

- www.uscis.gov. Look up employer's information. Learn how to document that your employee is not an illegal alien.

- www.dol.gov. The Department of Labor. Find out about those mandatory posters and other requirements.

- The equivalent web sites for your home state.