Tithes vs. Taxes

Deuteronomy 16:

16 Three times a year all your males must appear before the LORD your God in the place he chooses for the Festival of Unleavened Bread, the Festival of Weeks, and the Festival of Temporary Shelters; and they must not appear before him empty-handed.

17 Every one of you must give as you are able, according to the blessing of the LORD your God that he has given you.

(NET Bible®)

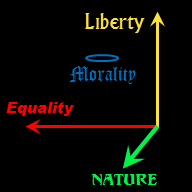

For many on the Christian Left, the income tax and welfare state are simply an extension of the idea of tithes. The Old Testament tithes function much like an income tax. Christians are supposed to give to help the poor. Put the two ideas together and the income tax/welfare state combination is simply the state enforcing part of Christian morality just as laws against polygamy, prostitution or working on Sunday are. As such, secularists could argue against the income tax and the welfare state on the same grounds as they argue against blue laws and nativity scenes on government property; a few – especially some followers of Ayn Rand – do just that.

I have objections to the current arrangement as well, but they are more subtle, a combination of the practical and the theological. On the practical side, the current welfare state is failing. Yes, we have fat poor people, but we also have a hideously complex tax system, a government going bankrupt, and a large dependent class. On the theological side, the income tax as a replacement for tithes conflates separate ideas.

- The Old Testament tithes were part of a system of mandated morality, but they were not the basis of a welfare system. (And the tithes themselves may have been voluntary as we’ll see below.)

- New Testament giving is the basis for a system of voluntary charity. A tithe to the poor does mesh well with New Testament teaching but getting the state to enforce Christian morality does not.

You might think I am nitpicking above, but the distinctions are important. A state mandated income tax is inherently complicated – even so for a flat tax. Charity is a very personal matter. With many givers who have personal knowledge of the recipients, ignorance of the economics of charity is made up for in part by flexibility, competition and the personal touch. With a government mandated welfare system, we must pay extra attention to economic incentives else very bad things happen.

The Old Testament does give us an example welfare system, one which incorporates subtle ideas of economics and natural rights. But said welfare system was not a matter of tithing and charity. If we on the Christian Left are to call for a state mandated welfare system, it behooves us to study the example given to us in the Bible, for there we can find much wisdom. Conversely, if we go back to the more spiritually fulfilling system of voluntary charity, it also behooves us to study the ancient welfare system. Voluntary donations rarely match tax receipts, so efficiency is important if we truly care about the plight of the poor.

Below we shall look at the original system of tithes and see how they played a very minor role in taking care of the poor. In subsequent chapters we will look at the many other provisions for the poor under Old Testament Law, the underlying principles of economics and natural rights, and possible modern implementations.

The First Tithe

Leviticus 27:

30 " 'Any tithe of the land, from the grain of the land or from the fruit of the trees, belongs to the LORD; it is holy to the LORD.

31 If a man redeems part of his tithe, however, he must add one fifth to it.

32 All the tithe of herd or flock, everything which passes under the rod, the tenth one will be holy to the LORD.

33 The owner must not examine the animals to distinguish between good and bad, and he must not exchange it. If, however, he does exchange it, both the original animal and its substitute will be holy. It must not be redeemed.' "

Numbers 18:

26 "You are to speak to the Levites, and you must tell them, 'When you receive from the Israelites the tithe that I have given you from them as your inheritance, then you are to offer up from it as a raised offering to the LORD a tenth of the tithe.

27 And your raised offering will be credited to you as though it were grain from the threshing floor or as new wine from the winepress.

28 Thus you are to offer up a raised offering to the LORD of all your tithes which you receive from the Israelites; and you must give the LORD's raised offering from it to Aaron the priest.

29 From all your gifts you must offer up every raised offering due the LORD, from all the best of it, and the holiest part of it.'

30 "Therefore you will say to them, 'When you offer up the best of it, then it will be credited to the Levites as the product of the threshing floor and as the product of the winepress.

31 And you may eat it in any place, you and your household, because it is your wages for your service in the tent of meeting.

32 And you will bear no sin concerning it when you offer up the best of it. And you must not profane the holy things of the Israelites, or else you will die.' "

(NET Bible®)

The first tithe went to the Levites, not to the poor. When the Israelites conquered Canaan, each tribe was allotted farm land save for the Levites. The Levites were given cities only, with but a small amount of surrounding land. The tithe to the Levites was thus compensation for landlessness, not a general income tax. The tithes described above applied to crops and farm animals only. Merchants, manufacturers and wage earners did not have to pay this tithe! (They were under the more open-ended mandate in Deuteronomy 16 cited at the beginning of this chapter.)

To many a modern mind, a “tax” on farmers only seems unfair. Today, we who live in developed nations multiply our labor with a tremendous amount of capital. In ancient times, capital was a much smaller factor in the economy; the primary multiplier of labor was land. The Old Testament Law recognized this fact several ways, including tithing requirement on farm products. Theologically, the tithe to the Levites was a proxy for a tithe directly to the Creator of the land.

This tithe was thus more a Georgist land rent more than a general income tax. But instead of assessing ground value, as Henry George advocated, this “tax” taxed the output of the land. (For a modern analog, some commercial real estate owners charge gross receipts percentage on top of a fixed rent.) This tithe differed from the modern income tax in another very important respect: enforcement. Net income is a fuzzy concept. How much did that tool really depreciate this year? Was that business trip really for business or was it a vacation in disguise? These and many other questions make income tax enforcement inherently complex even if we were to go to a simplified flat tax. The tithe described above is simple in that they are a fixed percentage of a finite set of outputs. They functioned more like payroll taxes or excise taxes than as a general income tax.

That is, the first tithe was a simple tax if it was a tax at all. The passages above have no enforcement provisions. What was the penalty for noncompliance? Who enforced compliance? Was this tithe a matter of enforced law or an act of personal faith? The text is unclear.

Under the New Testament the text is clearer: no enforcement save perhaps by shunning. Where the New Testament is less clear is to whom to pay this tithe – if this tithe is applicable at all. The New Testament deprecates the Levitical priesthood in favor of Jesus as high priest. Elsewhere I make the case that we give to Jesus by giving to help the poor, so under the New Covenant this tithe should now go for charity. But some would make the case that Jesus set up a new priesthood to replace the Levites, and they do have some passages to back up their claim. See The New Levites for a deeper study of the subject.

The Second Tithe

Deuteronomy 14:

22 You must be certain to tithe all the produce of your seed that comes from the field year after year.

23 In the presence of the LORD your God you must eat from the tithe of your grain, your new wine, your olive oil, and the firstborn of your herds and flocks in the place he chooses to locate his name, so that you may learn to revere the LORD your God always.

24 When he blesses you, if the place where he chooses to locate his name is distant,

25 you may convert the tithe into money, secure the money, and travel to the place the LORD your God chooses for himself.

26 Then you may spend the money however you wish for cattle, sheep, wine, beer, or whatever you desire. You and your household may eat there in the presence of the LORD your God and enjoy it.

(NET Bible®)

The second tithe was for celebration. You didn’t give this tithe away, you used it to party! And yes, the party could include booze—so much for the prohibitionists.

This tithe has no similarity to the modern income tax. It’s much more like the money we blow on celebrating Christmas or Thanksgiving. Thanksgiving is the better parallel, as two of the three holy seasons were at harvest time, and the fun centered on food and drink. (Christmas may well be a repackaged pagan celebration of the return of the sun. The Puritans thus banned Christmas, and some strict Christian denominations do likewise today.)

Since the Temple was destroyed, there is no appointed gathering place for these festivals. Methinks God allowed the Temple to be destroyed to allow Christianity to spread beyond a convenient distance from Jerusalem while still being in compliance with the Law – but this is conjecture. Maybe this tithe should be the source of funding for local church buildings as they are part of the cost of celebrating before the Lord.

The Third Tithe

The third tithe did indeed go to the poor – at least in part:

Deuteronomy 14:

27 As for the Levites in your villages, you must not ignore them, for they have no allotment or inheritance along with you.

28 At the end of every three years you must bring all the tithe of your produce, in that very year, and you must store it up in your villages.

29 Then the Levites (because they have no allotment or inheritance with you), the resident foreigners, the orphans, and the widows of your villages may come and eat their fill so that the LORD your God may bless you in all the work you do.

Deuteronomy 26:

12 When you finish tithing all your income in the third year (the year of tithing), you must give it to the Levites, the resident foreigners, the orphans, and the widows so that they may eat to their satisfaction in your villages.

13 Then you shall say before the LORD your God, "I have removed the sacred offering from my house and given it to the Levites, the resident foreigners, the orphans, and the widows just as you have commanded me. I have not violated or forgotten your commandments.

14 I have not eaten anything when I was in mourning, or removed any of it while ceremonially unclean, or offered any of it to the dead; I have obeyed you and have done everything you have commanded me.

15 Look down from your holy dwelling place in heaven and bless your people Israel and the land you have given us, just as you promised our ancestors — a land flowing with milk and honey."

(NET Bible®)

On the third year a tithe went to both the Levites and to the poor. Was this an additional tithe? Or was this simply a different designation for the first tithe for the third year? Or, was tithing limited to the third year? The text is unclear, but I read this as an additional special offering for the third year.

Regardless, these passages indicate tithes for the poor only on the third year. In other words, we have less than a 3.3% annual tax on farm income designated for the poor! But that is assuming that “the third year” means every third years. For reasons I’ll explain later, I believe “the third year” meant the third year in the seven year cycle of Sabbath years. If I am correct, tithing contributed less than 1.4%/year on average toward feeding the poor. Rather stingy, indeed!

Stingy, if tithing was the basis for taking care of the poor. Under the Old Covenant, it was not. The third tithe was but a small supplement to the real welfare system, which we shall begin investigating next.