Tax Reform – A Balanced Approach

The United States tax code is a mess, a colossal mess. It complicates our lives, strangles the economy, subsidizes suburban sprawl, encourages corporate consolidation, and makes healthcare more expensive.

And it’s not all that progressive anymore. Billionaires pay lower tax rates than family doctors. And that’s before taking into account tax loopholes that you could drive a container ship through – literally. Meanwhile, our feeble attempts to help the working poor get eaten up by shady tax preparation services that blight our poorer neighborhoods. Read the earned income credit instructions, and despair.

Every four years or so, some prominent Republicans come up with new tax reform plans. Some of the ideas are truly simpler than what we have today. Alas, most are also thinly-veiled excuses for yet more tax cuts for the rich – not a good idea in this second Gilded Age, when young communists litter the sidewalks. Their plans generally come up short on revenue as well, which is insane given our enormous national debt.

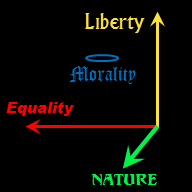

It’s high time for a better approach to tax reform, one which takes into account multiple dimensions of interest.

Tax Reform Should be Progressive

The gap between the .01% and the rest of us grows ever wider. Warren Buffet begs to be taxed more. Silicon Valley startup billionaires play Liberaller than Thou.

Fortunately, progressive does not have to be complicated. If we start with a generous prebate, almost any tax can be progressive at the bottom end. We only need to add some surcharges for the truly rich to make the system progressive overall – and the super rich can afford accountants.

In fact, with a couple more tricks I can turn our income tax into a flat tax for the 99% that’s simpler than most Republican flat tax proposals, and still more progressive than what we have today.

Tax Reform Should be Green

Our current tax code encourages natural resource exploitation over labor. Given how we have a filled up planet and millions of bored underemployed men, this is a bad policy. It is time for a green tax shift.

It’s also time to stop subsidizing suburban sprawl, which we do today via the home mortgage deduction.

Tax Reform Should Foster Liberty

Today, the IRS not only takes your money, it tells you how to spend what is left. The amount of personal information you have to provide on your tax forms is a complete reversal of the spirit of the 5th Amendment to the Constitution. You do not have the right to remain silent.

And soon, you won’t have the right to use cash. We are moving towards a dystopia predicted by Ron Paul decades ago, where corporations and governments track your every purchase. Already any bill higher than a $20 is looked at with suspicion. Make a significant cash withdrawal from your bank account and you might lose it.

Look at some comedies from the 50s and 60s. Rich people had thousand dollar bills, which would be ten thousand dollar bills in today’s currency. Yes, this was silly even then, but thousand dollar bills did exist, and it wasn’t illegal to use them.

We can restore our privacy with the right tax reforms.

Taxes Could be Less Immoral

Libertarians like to say “Taxation is theft,” and they have a point. But unlike burglars, governments do provide services in return, some of them useful. If those services are worth twice what you would pay in the private market under anarchy, then taxation is theft with adequate compensation. (Murray Rothbard himself wrote that paying back double is adequate compensation for theft.)

For the compensation to be adequate, government should stick mostly to true natural monopoly functions, and do them well. Also, taxes could be more proportional to services rendered.

This does, however, run us into problems on the bottom. Net tax recipients are not paying for government services. To justify a generous prebate/citizen dividend, we need to turn to a generalized theory of natural rights.

Tax Reform Needs to be Practical

Simpler taxes are practical. It’s today’s nightmarish mess of exceptions and loopholes that’s impractical.

Alas, most aspiring tax reformers are impractical in other ways. They misuse the magic of the Laffer Curve. They overestimate the economic growth that will come from a simpler tax system. And some fail to deal with the difficulties of collecting income tax alternatives. (I’m talking to you, Fair Tax fans.)

They also explicitly advocate revenue neutral reforms, which is bad even before the excessive optimism.Tthe government needs more money – a lot more. We have a $19 trillion dollar debt and the Baby Boomers are starting to retire! (And yes, we need spending cuts as well. No argument there.)

But perhaps the biggest fantasy is abolishing the tax code and the IRS in one fell swoop and replacing them with something new. This is the political equivalent of trying to get rich by buying lottery tickets. It won’t happen. We need to take incremental steps to get out of this mess. We can start with some revenue enhancements for Ron Paul fans.