Welfare Option 2: The Big Flat Entitlement

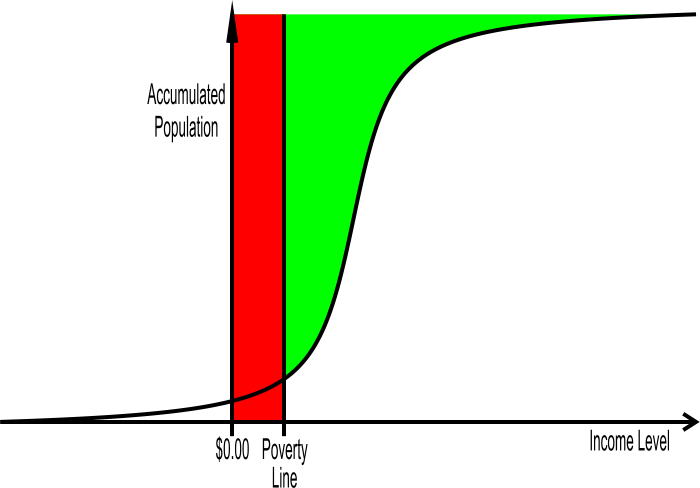

Now, let us look at the opposite extreme. Instead of having either a poverty or a disability test, we simply give everyone a welfare check (free money!!). Such an approach does eliminate the perverse incentive of the simplistic approach, and it would get everyone's income up to the poverty line (but it wouldn't by itself handle special needs). The cost of such a program is represented in the next figure.

Of course, this chart is unrealistic, since someone has to lose income in order to pay for this block of benefits! And if this tax reaches the lower income earners, we can get back into perverse incentive mode. However, the chart is useful to visually get a feel for how much of the national income must be taxed in order to provide the benefit.

Instead of getting fancier with the charts, I will work some real numbers. Like any good physics teacher, I will simplify and round with abandon. The Vulcans in the audience can go to the Census, Treasury, and Health and Human Services web sites in order to get better numbers and refine my work.

Let us take a poverty line as $8,000 per adult and $4,000 for each child in a family. This is a bit under HHS figures for single adults, but it sets a significantly higher line for married adults than HHS uses. But since I want to avoid paying people to act poor, I will not do a marriage penalty. Set the adult population to be 75% and minors 25%. Use a population of 300 million (a bit high compared to census figures, but I wouldn't be surprised to see more people coming out of the woodwork to claim this benefit; then again, how many are legally here?). We have:

300*10^6 * (8000 * .75 + 4000 * .25) = 300*10^6 * (6000 + 1000) = 2100 * 10^9 = 2.1 TRILLION DOLLARS

Compare this with a 2.0 trillion dollar federal budget for fiscal year 2001 [source: IRS 1040 instruction book] and realize that this is rather a lot. I suspect freedom lovers in the audience are seeing red, and I have to agree. This is unacceptable. And the idea of privatizing such a huge payout is laughable.

But before we throw the idea out completely, we might use such a system to actually simplify government. Suppose we wanted to replace the income taxes with consumption taxes (excise taxes, tariffs and/or a national sales tax). A primary objection to doing this is that such a tax would be comparatively regressive compared to our current system. With income tax, we have deductions and personal exemptions. Suppose we were to give out the value of the personal exemptions and deductions as a flat entitlement/refund check to everyone. Then, we could eliminate personal tax filing entirely.

This could even be done with our current system of labor and income taxes. Instead of having each laborer file a form to get some back according to a maze of exemptions, and have employers track the number of exemptions for each employee, employers could simply pay a flat rate labor tax. Then, all citizens would get a “refund” check each month regardless of work status. For those making less than the refund quantity, the “refund” would be effectively a welfare check, but there is still an incentive to work as long as the overall tax rate is not too high.

For some numbers: the single person's standard deduction is $4,700 this year; let's round up to $5000. The personal exemption is $3000/person. Without a marriage penalty, we have $8000/adult and $3000/child (roughly! some dependents are not children). If we have a 33% tax rate for everyone, we get a refund check of $2666 per adult and $1000 per child per year. This comes out to $222/month per adult and $83/child. Not much to live on, but it isn't trivial.

The idea of a flat tax probably sends alarm bells to the liberals in the audience and the 33% figure alarms conservatives and freedom lovers. Keep this in mind: if you combine the current personal income tax with Social Security and Medicare taxes, the tax code isn't all that progressive right now, and the 33% figure is pretty close to what we now pay.

That said, I don't like this much because it still is an income tax. Sole proprietors and contractors still have to report their accounting to the IRS to determine income. As such, any income tax is unacceptably complex in my opinion.